Government Mileage Reimbursement 2025 - Gsa Per Diem Rates 2025 Mileage 2025 Janaye Zulema, The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025. Confused by the 2025 hmrc mileage rates? Current Gsa Mileage Rate 2025 Allyce Corrianne, Rates are reviewed on a quarterly basis. The kilometric rates (payable in cents per kilometre) below are payable in canadian funds only.

Gsa Per Diem Rates 2025 Mileage 2025 Janaye Zulema, The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025. Confused by the 2025 hmrc mileage rates?

2025 Tax Mileage Rate Lela Shawna, Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred. You may provide an allowance or a reimbursement to your employee to compensate for use of their automobile or motor vehicle in connection with or in the course of their office or.

The general services agency (gsa) has released new rates for reimbursement of privately owned vehicle (pov) mileage for 2025. Understand employee mileage reimbursement, why it matters, how to calculate it using irs rates, and the benefits of a clear policy for your business.

Mileage Rate Reimbursement 2025 Vera Allison, Ensure compliance with our guide. On december 14, 2025, the internal revenue service (irs) announced the 2025 standard mileage rate.

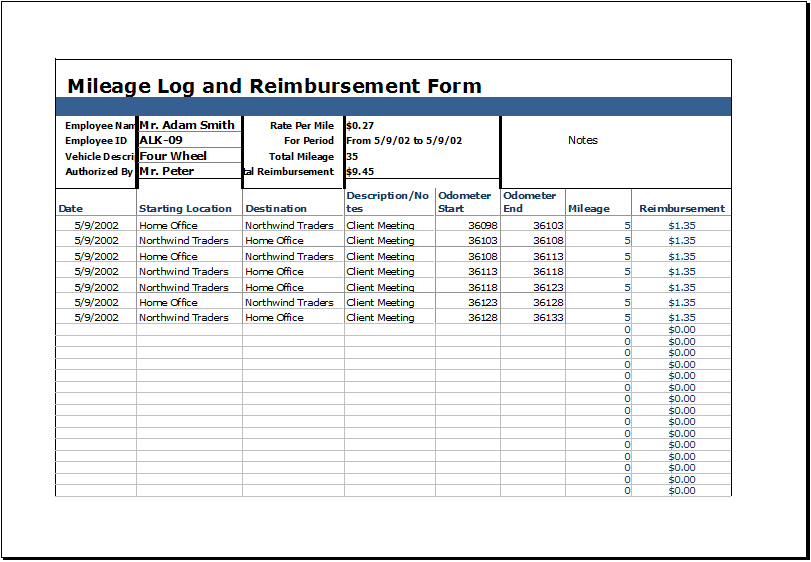

Mileage Reimbursement 2025 Form Excel Esta Alexandra, Travel — mileage and fuel rates and allowances. Rates are reviewed on a quarterly basis.

Government Per Diem Rates 2025 For Mileage 2025 Jania Lisetta, Ensure compliance with our guide. Understand employee mileage reimbursement, why it matters, how to calculate it using irs rates, and the benefits of a clear policy for your business.

This article explains current rates and how timeero automates tracking to simplify reimbursements.

What Is The Government Mileage Rate For 2025 Heda Rachel, The new rate kicks in beginning jan. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Government Mileage Reimbursement 2025. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. Ensure compliance with our guide.

What Is The 2025 Irs Mileage Reimbursement Rate Connie Constance, The new rate kicks in beginning jan. On december 14, 2025, the internal revenue service (irs) announced the 2025 standard mileage rate.

Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2025.

Ontario Government Mileage Rate 2025 Rebe Alexine, Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred. If you are authorized to travel by a privately owned vehicle (pov) for local, temporary duty (tdy), or permanent change of station (pcs) travel,.

Irs Increases Mileage Rate For Remainder Of 2025 Angel Blondie, You may provide an allowance or a reimbursement to your employee to compensate for use of their automobile or motor vehicle in connection with or in the course of their office or. The kilometric rates (payable in cents per kilometre) below are payable in canadian funds only.